New York

CNN

—

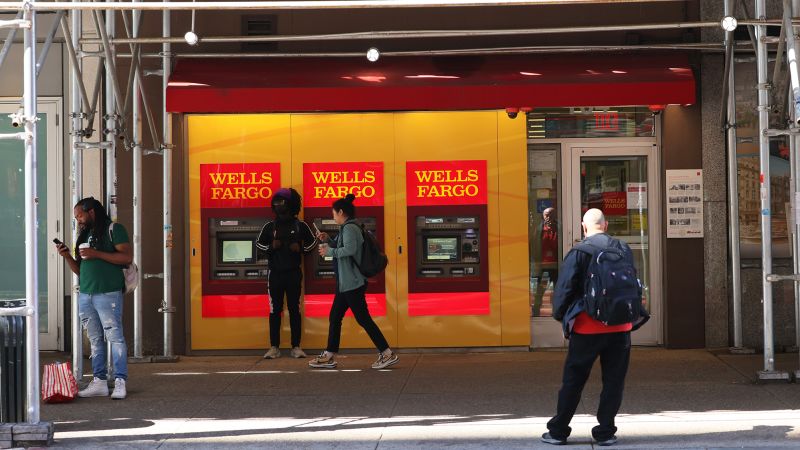

Wells Fargo, lengthy one of many greatest gamers within the mortgage enterprise, is taking an enormous step again.

The scandal-ridden financial institution introduced a big shift on Tuesday to focus its mortgage enterprise on serving financial institution clients and minority homebuyers as a substitute of buying new clients.

Wells Fargo stated it would additionally exit its correspondent enterprise, which buys loans made by different lenders, and cut back the scale of its mortgage servicing portfolio.

The retreat will possible trigger Wells Fargo to put off a minimum of some workers, although the financial institution didn’t announce any specifics. A spokesperson declined to touch upon potential layoffs.

“Mortgage is a vital relationship product, and our purpose is to proceed to be the first lender to Wells Fargo financial institution clients in addition to minority homebuyers,” Kleber Santos, Wells Fargo’s head of client lending, stated in an announcement.

The transfer comes as Wells Fargo continues to be in hassle with regulators. Final month, the Shopper Monetary Safety Bureau ordered Wells Fargo to pay a document high-quality of $1.7 billion for “widespread mismanagement” over a number of years that harmed 16 million buyer accounts.

In an interview with CNBC, Santos stated the financial institution’s authorized issues helped trigger the choice to step again from the mortgage market together with the spike in rates of interest.

“We’re conscious about Wells Fargo’s historical past since 2016 and the work we have to do to revive public confidence,” Santos instructed CNBC. “As a part of that evaluation, we decided that our house lending enterprise was too giant, each when it comes to total dimension and its scope.”

Ted Rossman, senior trade analyst at Bankrate.com, stated Wells Fargo has “been dogged by numerous regulatory scandals, and it’s additionally a troublesome time for the mortgage market proper now.”

Rossman stated the financial institution’s change “is paying homage to what another massive banks like Financial institution of America and Chase went via after the monetary disaster. They’ve gotten extra into buying and selling and bank cards and are focusing much less on the mortgage enterprise, which now counts nonbank fintechs corresponding to Rocket Mortgage and loanDepot amongst its largest gamers.”

“The regulatory surroundings, the economics and the chance/reward calculus of being within the mortgage market have modified considerably in recent times,” Rossman stated.

In late 2017, Quicken Loans toppled Wells Fargo as America’s largest mortgage lender.