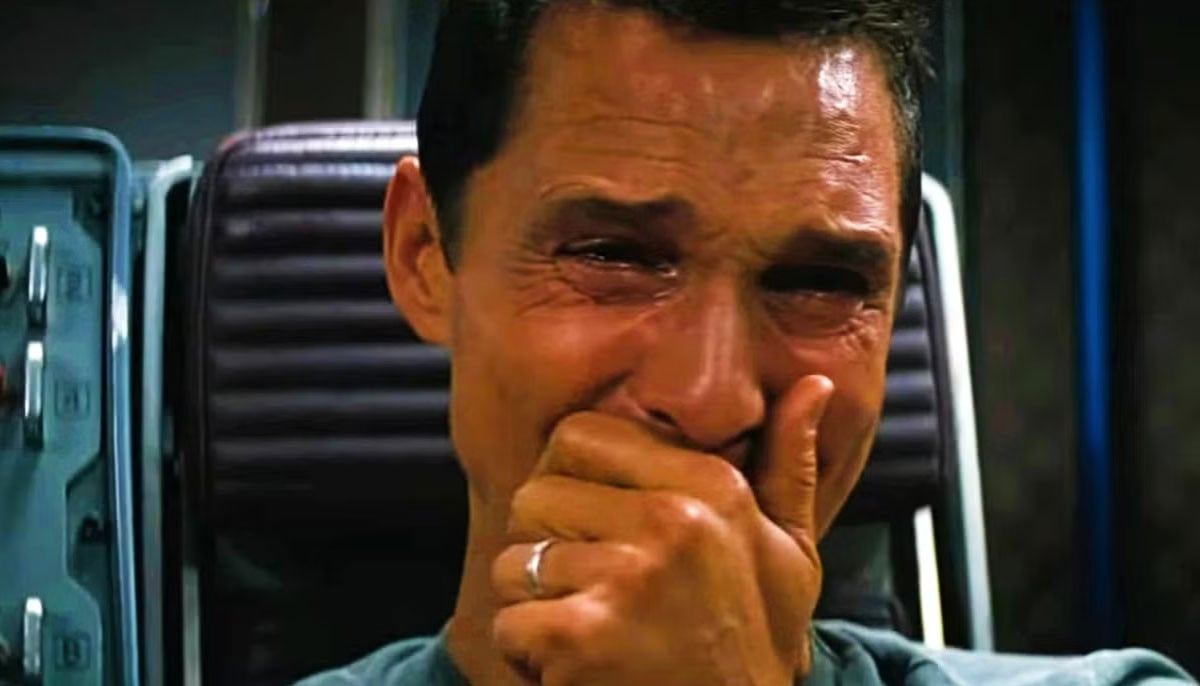

Federal Reserve Chair Jerome Powell attends a press convention in Washington, D.C., Could 4.

Photograph:

Liu Jie/Zuma Press

Federal Reserve Chairman

Jerome Powell

has taken of late to praising legendary Chairman

Paul Volcker,

as a sign of his new inflation-fighting willpower. However Mr. Powell put Tall Paul on maintain on Wednesday as he walked again among the hawkishness that he and his colleagues have exhibited in current weeks.

The Federal Open Market Committee raised its goal fed funds fee by 50 foundation factors, as anticipated. However the information is that Mr. Powell signaled the Fed could not have to be as aggressive to counter inflation as markets had thought.

He all however took a 75-basis-point enhance at a future assembly off the desk. He mentioned he doesn’t see indicators of “a wage-price spiral” that will embed inflation expectations. He mentioned there are indicators that inflation within the Fed’s favourite value index has peaked. And he signaled a slower tempo of decline within the Fed’s bond portfolio—aka, quantitative tightening—in comparison with earlier hints.

Mr. Powell additionally continued to place the blame for inflation on different components than financial coverage. Not way back the wrongdoer was the pandemic and provide chains. Now it’s the struggle in Ukraine and China’s Covid lockdowns. The one factor he and the Fed don’t wish to concede is that the central financial institution is essentially in charge.

The markets cherished what they heard and bid up equities and bonds. Inventory indexes rose by about 3%. Mr. Powell additional contributed to the nice cheer by saying the financial system stays sturdy, blowing previous the primary quarter decline in gross home product. No less than for a day, traders have been discounting fears of recession.

The query is whether or not this leisurely tempo of financial tightening is ample to cut back inflation. There’s motive to marvel. Financial coverage stays remarkably free, with a fed funds fee pegged to 0.75%-1%. Even when the Fed follows with a pair of fifty foundation level will increase at its subsequent two conferences, actual rates of interest will stay destructive.

The historical past of fast inflation is that it takes a fed funds fee that’s greater than the tempo of value will increase to interrupt inflation. If Mr. Powell is correct that inflation is about to move downward, and maybe quickly, then his gradual tempo of tightening could repay. But when inflation stays doggedly excessive, he’s storing up more durable tightening selections down the highway.

Paul Volcker was a refined central banker, however one lesson from his profession is that when the Fed decides to interrupt inflation, higher to go forward and do it. Ready makes it worse.

Copyright ©2022 Dow Jones & Firm, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Appeared within the Could 5, 2022, print version.