In the course of the previous decade, a critique of neoliberalism has develop into widespread within the progressive wing of the Democratic Occasion. In the course of the Seventies, the argument goes, many Democrats espoused the pro-market, antigovernment views lengthy related to opposition to the New Deal and the trendy welfare state. Within the title of effectivity, progress and decrease costs, the Carter administration deregulated airways, trucking and different sectors. The Clinton administration espoused free commerce and the unfettered circulate of capital throughout nationwide boundaries. In response to the Nice Recession, President

Obama’s

financial advisers targeted on the well being of large banks and tolerated a grindingly gradual restoration.

The issue, critics allege, is that these insurance policies ignore deprived People who don’t profit from broad market-driven insurance policies. Markets, they are saying, are detached to equitable outcomes. The deal with combination progress comes on the expense of equity, which requires advantages and alternatives focused to marginalized teams. By rules and wealth transfers, authorities should lean towards markets to realize acceptable outcomes.

On this narrative of the previous half-century, critics typically mark the Clinton administration because the second when institution Democrats capitulated to the ideology of the unfettered market. Poor and working-class People paid the value, they cost, with decrease pay, diminished job safety, and the collapse of complete sectors uncovered to commerce competitors.

The historic file tells a distinct story.

Start with the financial aggregates. Throughout eight years of the Clinton administration, annual actual progress in gross home product averaged a sturdy 3.8% whereas inflation was restrained, averaging 2.6%. Payrolls elevated by 22.9 million—practically 239,000 a month, the quickest on file for a two-term presidency. (Month-to-month job progress in the course of the Reagan administration averaged 168,000.) Unemployment fell from 7.3% in January 1993 to three.8% in April 2000 earlier than rising barely to 4.2% on the finish of President Clinton’s second time period. Adjusted for inflation, actual median family earnings rose by 13.9%.

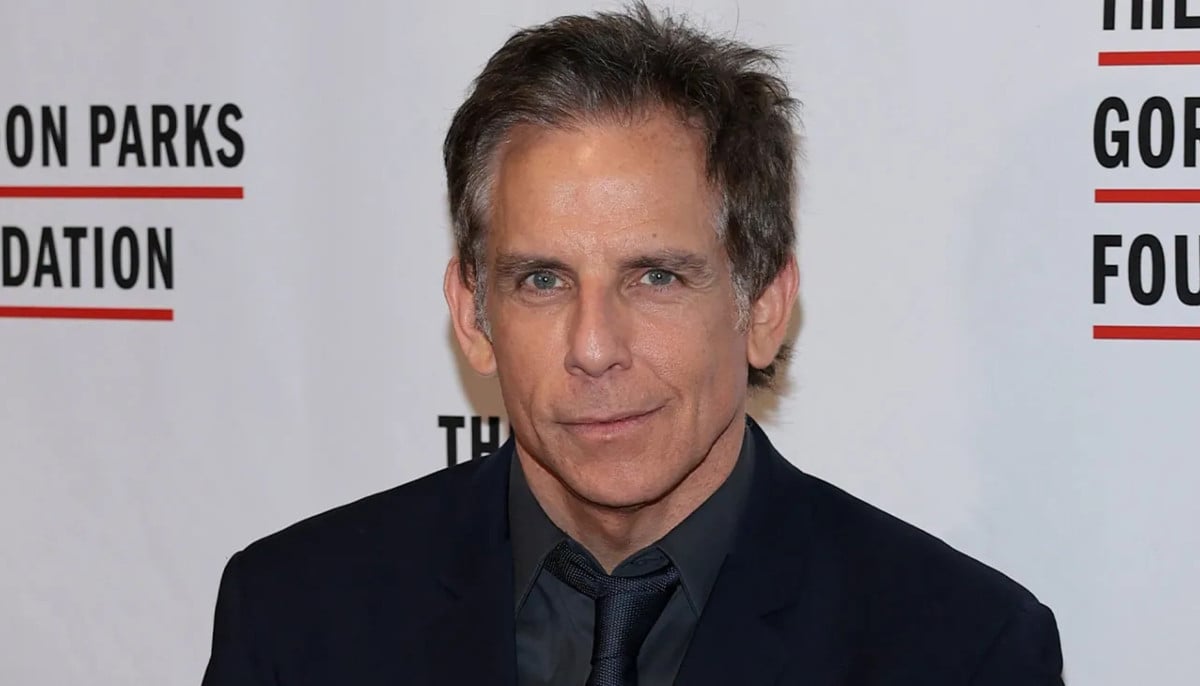

Mr. Clinton inherited a considerable funds deficit. Regardless of this, one group of administration officers, headed by Labor Secretary

Robert Reich,

urged him to suggest a serious stimulus package deal to speed up financial progress and scale back unemployment extra rapidly. He refused, focusing as a substitute on lowering inflation and rates of interest to create the circumstances for long-term progress. (I labored within the White Home on the time however had no position in financial coverage.) In the course of the administration, federal spending as a share of GDP fell from 21.2% to 17.5%, and federal debt as a share of GDP fell from 61.4% to 54.9%.

What concerning the North American Free Commerce Settlement, which Mr. Clinton pushed via Congress over the objections of a majority of his personal get together within the Home? Didn’t it eviscerate the manufacturing sector? Little doubt the settlement decreased jobs in some areas, however manufacturing jobs elevated throughout Mr. Clinton’s eight years. The collapse occurred throughout

George W. Bush’s

administration, when 4.5 million manufacturing jobs disappeared and have by no means been regained. (Manufacturing employment in April 2022 is about the place it was when Mr. Bush left workplace 13 years in the past.)

What concerning the poor? The poverty price declined in the course of the Clinton administration by practically one quarter, from 15.1% to 11.3%, close to its historic low. And it declined even sooner amongst minorities—by 8.1 share factors for Hispanics and 10.9 factors for blacks.

What concerning the distribution of beneficial properties from financial progress? Earnings beneficial properties for working-class households equaled the nationwide common, and beneficial properties for the working poor rose even sooner. White households gained a median of 13.9%, however minorities gained much more: 22.0% for Hispanics and 31.5% for blacks.

In sum, in the course of the heyday of neoliberalism, People weren’t compelled to decide on between excessive progress and low inflation or between combination progress and equity for the poor, working class and minorities. This helps clarify why Mr. Clinton’s job approval stood at 65% when he left workplace.

We will’t return to the Nineteen Nineties, however there are classes from the previous. Deregulation can go too far, however so can regulation. The market doesn’t mechanically produce acceptable outcomes for society, however neither does authorities. In these and different respects, coverage makers must discover a cheap steadiness, the situation of which will depend on ever-changing circumstances. No algorithm can substitute for common sense guided by research and customary sense.

In our effort to reply to the pandemic generously and humanely, we misplaced our steadiness. We’ve got discovered the laborious means that demand doesn’t mechanically create its personal provide and that dangerous issues occur when an excessive amount of cash chases too few items. As we battle to regain equilibrium, the critics of neoliberalism have a lot to be taught from an administration whose financial efficiency might be laborious to beat.

Copyright ©2022 Dow Jones & Firm, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8