Liquid Dying raised a recent funding spherical Monday, bringing its valuation to $700 million. Since its launch in 2019, the model has had explosive development thanks in a part of due to its loyal followers, subversive advertising and distinctive packaging that its newest investor thinks it is perhaps the “quickest rising non-alcoholic beverage of all time.”

Science Ventures led the most recent spherical of $70 million. Liquid Dying stated it’s on monitor to usher in $130 million in income this 12 months — almost triple final 12 months’s income.

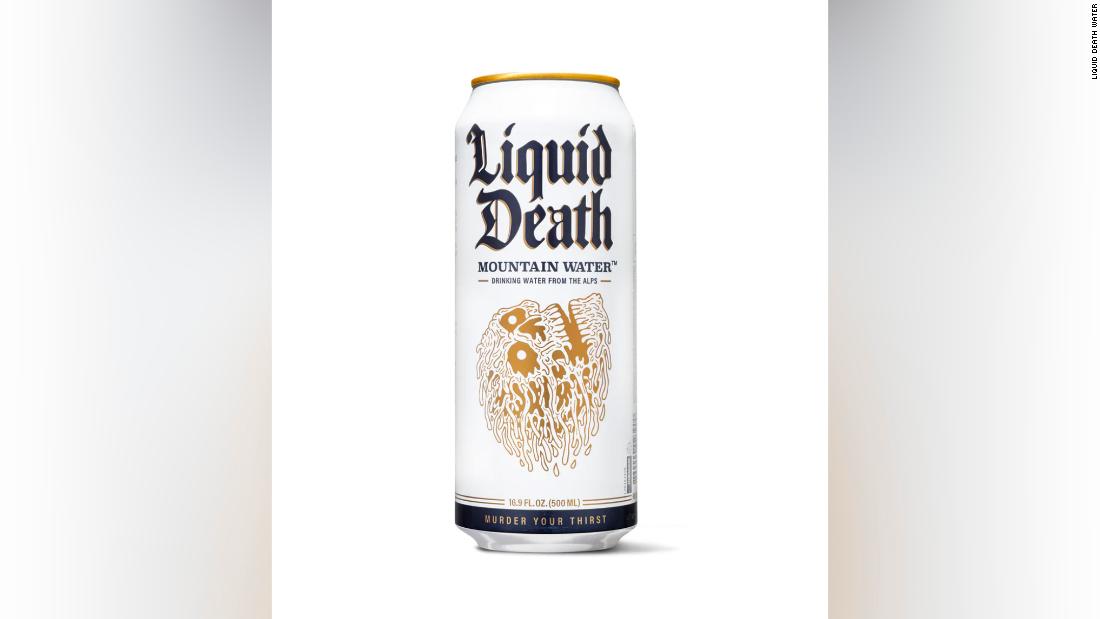

Liquid Dying is offered in 16-ounce cans at well-liked shops (together with Goal, 7-Eleven and Entire Meals), on-line and at live shows due to a deal it has with Stay Nation. It just lately expanded into flavored seltzer with distinctive flavors equivalent to “Mango Chainsaw” and “Severed Line.”

Pham stated the corporate’s identify helped bolster its success.

“Like Tesla moved drivers towards better-for-the-planet EVs by smooth a terrific product and model that grew to become a part of tradition,” Pham wrote. “Liquid Dying is shifting individuals towards more healthy and sustainable consuming choices, not by preaching to them, however by entertaining them and making them part of one thing greater in tradition.”

On-line chatter and fandom may also be credited for its fast rise in reputation.

“Many of the Twitter influencers have outlined this non-alcoholic beverage model as one of many quickest rising and appreciated its eco-friendly technique which might disrupt the non-alcoholic beverage market,” wrote Smitarani Tripathy, social media analyst at GlobalData in a notice Tuesday.