The loss of life knell for company America’s biggest particular person experiment in mergers and acquisitions sounded in November 2021 when Basic Electrical introduced its intention to separate in three. A thousand offers have been struck by Jack Welch, its notoriously gung-ho boss who ran the American industrial and monetary big between 1981 and 2001, a tempo that didn’t slacken beneath his successor, Jeffrey Immelt. The end result has been a monumental destruction of shareholder wealth. The agency’s market worth peaked at $594bn in 2000. At this time it’s a comparatively measly $83bn.

This lesson however, bosses simply can not shake the necessity to shake palms. In 2021 dealmaking reached fever-pitch: a file $5.9trn-worth have been introduced globally, $3.8trn by working firms and the steadiness by private-equity funds and special-purpose acquisition firms. Competitors for belongings was fierce and due diligence frenetic. The price of capital was traditionally low and consumers paid top-notch costs, at a file median valuation of 15.4 occasions earnings earlier than curiosity, tax, depreciation and amortisation (ebitda), in response to Bain, a consultancy. The variety of offers for highly-valued expertise companies soared, accounting for 1 / 4 of the overall quantity.

If historical past is any decide, many of those offers will destroy worth. It’s simple to establish disastrous offers: massive goodwill write-downs and even chapter are helpful signposts. However measuring the efficiency of the common deal is hard; relative share value efficiency is a fast however noisy measure and asking a counterfactual “what if” query is crystal-ball stuff. A current overview of educational literature by Geoff and J. Homosexual Meeks at Cambridge College, estimates that solely a fifth of research conclude that the common deal produces larger mixed income or will increase the wealth of the acquirer’s shareholders. McKinsey, one other consultancy, reckons that companies pursuing massive offers between 2010 and 2019 had solely a coin-flip probability of making extra shareholder returns. Sufficient to place common Joes off dealmaking, however not budding Neutron Jacks.

These probabilities of success are additional lowered by the circumstances through which the most recent crop of offers have been struck. Instances of frenzy, like final yr, are notably dangerous for matching appropriate consumers and sellers. Dealmaking tends to snowball as chief executives, eager to develop their dominions (and compensation), watch others make their strikes and are unable to face idly by whereas rivals make hay. Unprecedented competitors from private-equity funds solely intensifies the urge to maneuver quick. Compounding their zeal are the middlemen. Funding bankers, who receives a commission by the deal moderately than by the hour, persuade them something is feasible: flattery is tough forex out there for recommendation.

There are few brakes on this prepare. The place activist buyers may agitate on the sell-side of a transaction for a better value (usually efficiently), this sort of scrutiny is much less frequent on the buy-side. Robust shareholder dissent in response to Unilever’s abortive $66bn bid for gsk’s client health-care division in December 2021 is an all-too-rare instance of householders holding trigger-happy administration to account. At this time the division, known as Haleon, is listed on the London Inventory Trade, valued at round half of Unilever’s provide.

The result’s formidable offers made at excessive costs. Decrease asset values are already exposing the flawed logic of some struck on the prime of the market. In August Simply Eat Takeaway.com, a European food-delivery agency, introduced a write-down of the worth of Grubhub, its distracting American misadventure, by $3.3bn, barely a yr after finishing this $7.3bn deal.

As fairness markets tumbled this yr, the shotgun weddings introduced in 2021 have been being consummated. After the joys of courtship begins the exhausting job of post-merger integration. This complicated course of is the area of consultants, organisational charts and budgeting, moderately than clandestine negotiations and punchy projections. It’s being turned on its head by a mixture of inflation and slowing progress. Bosses wager large that prime costs could be justified by larger income. They’re now working new companies in a brand new world.

Patrons are likely to overestimate the operational advantages of lumping two companies collectively (“synergies” in company converse). Typically promised however seldom totally delivered, these projections persuade bosses that the pin manufacturing facility is healthier of their palms than these of private-equity’s monetary wizards. Scale was the idée fixe of dealmaking throughout 2021. Such offers are normally predicated on heavy value reducing, which is much more durable whereas inflation rages. Add present supply-chain chaos to yo-yoing enter prices, and managers quickly discover their powers waning.

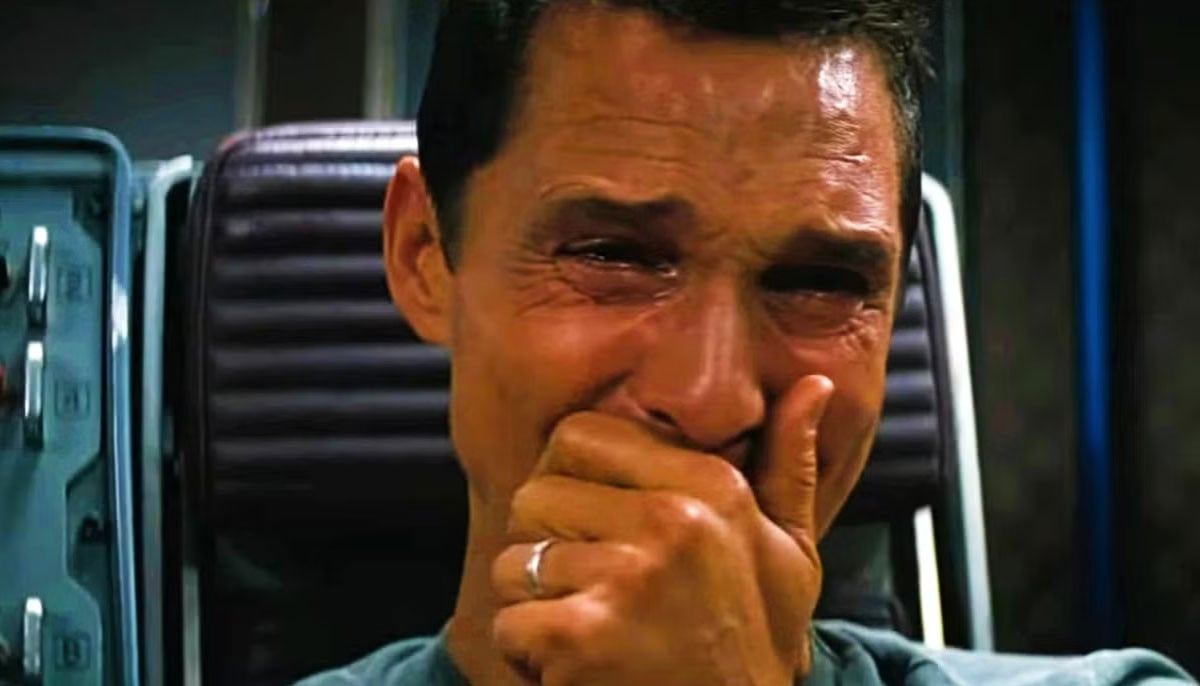

That issue is obvious at Warner Bros Discovery, an American media big fashioned in April 2022 by the merger of Discovery and WarnerMedia. In an trade among the many worst at realising such targets got here a promise of $3bn of annual financial savings. Rising prices and cyclical pressures on promoting income imply that integration will likely be tougher than deliberate. Expectations for ebitda in 2023 are actually $12bn, moderately than $14bn when the merger was introduced. The response of David Zaslav, the agency’s boss, has been to tighten the screws even additional (see subsequent article).

Labour is commonly the primary value bosses flip to, even when heavy layoffs develop the prospect of rifts between new bedfellows. Most of the most spectacular blow-ups have concerned cultural transplant-rejection on the highest ranges, although as in aol and Time Warner’s ill-fated $165bn tie-up in 2001 that is normally a symptom moderately than reason behind strategic mismatch. But the true dangers happen additional down the food-chain as labour markets proceed to convulse. The flexibility to retain good employees (“expertise” within the integration dictionary) is important. It comes excessive on the checklist of explanation why offers reach a current survey performed by Bain.

The struggle for expertise has rapidly changed into an excellent hiring freeze within the expertise sector, however elsewhere labour shortages are the norm. Vital challenges await the mixing of Canadian Pacific Railway and Kansas Metropolis Southern, a $31bn deal introduced in September 2021 which is awaiting its last regulatory stamps. The merger in 1968 of Pennsylvania and New York Central Railroad gives a warning from historical past. Shortly earlier than the brand new entity’s chapter in 1970, an inner report laid naked the position of excessive workers turnover in its failed integration: 61% of prepare masters, 81% of transport superintendents and 44% of division superintendents had been of their job for lower than a yr.

The dealmakers of 2021 entered the current inflationary interval with a excessive bar to clear as a way to justify the top-of-market offers they struck. As of now the mega-disasters of this wave of mega-deals are issues of hypothesis, although nobody doubts they’ll emerge. Even this is not going to be sufficient to persuade bosses to kick their dealmaking behavior, at the very least whereas company balance-sheets stay sturdy, and exercise has been remarkably resilient in 2022. Till bosses may be persuaded of different makes use of for his or her income, new challenges imply solely new sorts of offers. No less than this yr there could also be just a few bargains available. ■