Fresh revelations have surfaced regarding the royal family’s financial dealings and private estates, thanks to an in-depth investigation by Channel 4’s Dispatches and the Sunday Times.

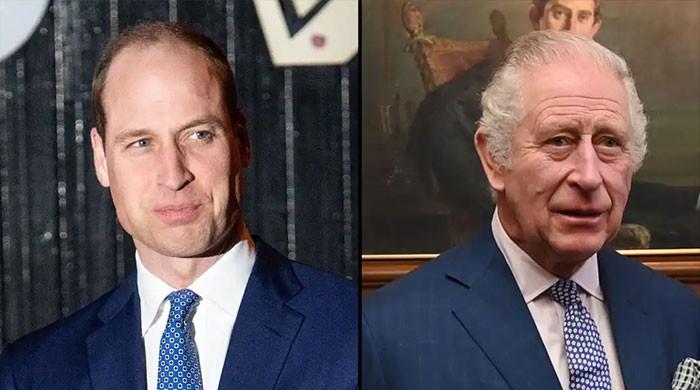

According to their findings, the Duchies of Lancaster and Cornwall — the private estates of King Charles and Prince William, respectively — have secured millions in revenue through contracts with public bodies and charitable organizations.

These agreements are projected to generate a staggering £50 million in the years to come.

The Duchy of Lancaster, which dates back to the 14th century, serves as a trust for the Sovereign, encompassing a vast portfolio of land, historic properties, high-quality farmland, and areas of natural beauty across England and Wales.

This historic estate has been integral to royal finances, supporting the monarchy through its considerable asset base and strategic developments.

The Duchy of Cornwall, a parallel estate to Lancaster, holds an impressive value exceeding £1 billion and provides substantial income to the heir to the throne.

Both the Duchy of Lancaster and the Duchy of Cornwall enjoy exemptions from Corporation Tax and Capital Gains Tax.

Although King Charles and Prince William aren’t legally obligated to pay income tax on their earnings from these estates, they have opted to do so voluntarily.

This choice, however, comes amid growing public scrutiny over the unique financial privileges these royal estates enjoy and their significant economic influence.

_updates.jpg)