THE CHINESE COMMUNIST PARTY has exhibited a excessive tolerance for the excruciating ache felt by traders in China’s greatest know-how corporations. The companies’ sins ranged from throttling smaller opponents and mistreating employees to hooking younger minds on video video games. After forcing Didi International to delist from New York, final week regulators in impact scotched the ride-hailing big’s relisting plans in Hong Kong. On March 14th the Wall Road Journal, a newspaper, reported that they’re making ready to slap a document nice on Tencent, an web Goliath, for alleged anti-money-laundering violations. The subsequent day the Our on-line world Administration of China (CAC), the principle web watchdog, accused Douban, a social-media platform with 200m customers, of making “extreme on-line chaos”, marking it as a goal for stricter censorship. This, mixed with uncertainty over Russia’s invasion of Ukraine and a rash of covid-19 outbreaks, shaved a 3rd from the indices of Chinese language tech shares within the first two weeks of March, whereas America’s tech-heavy NASDAQ index remained flat (see chart).

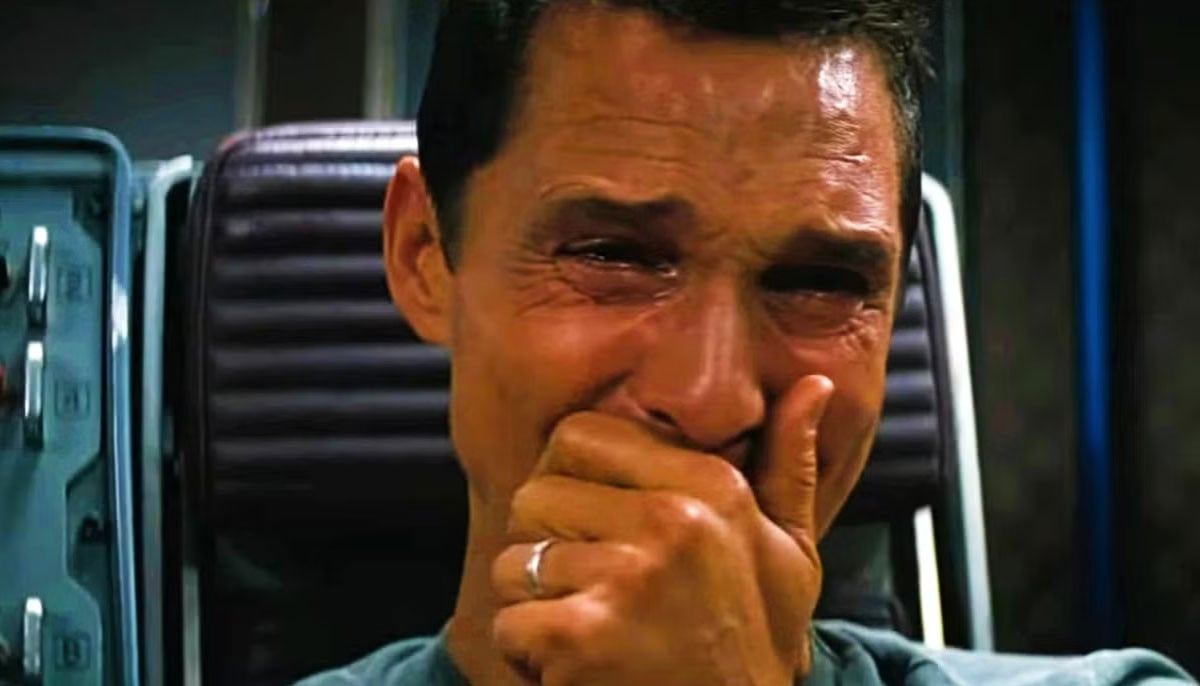

But the ache of the spiralling tech sell-off, which at its deepest worn out greater than $2trn in total market worth, could also be changing into to a lot to bear even for desensitised get together bosses. On March sixteenth Xinhua, a state information company, revealed a report from a gathering of the central authorities chaired by Liu He, China’s high financial adviser. The company declared that the “rectification” of huge Chinese language know-how corporations would quickly come to an in depth. New rules must be clear, Mr Liu was alleged to have urged, and policymakers have to be cautious when implementing guidelines that may damage the market, in accordance with Xinhua. Furthermore, state media reassured readers, the Chinese language management would stabilise stockmarkets. It might even assist abroad listings of Chinese language corporations, which it has discouraged or, as in Didi’s case, opposed.

Mr Liu’s statements are the strongest sign up to now that the tech crackdown initiated by President Xi Jinping in late 2020 is coming to an finish, says Larry Hu of Macquarie, an funding financial institution. Markets definitely appear to assume so. Hong Kong’s Hold Seng Tech Index soared by 22% on March sixteenth, a document. The Golden Dragon index, which tracks American-listed Chinese language know-how companies, jumped by 1 / 4 when buying and selling started. Having misplaced tens of billions of {dollars} of market worth in latest days, put-upon tech titans akin to Tencent and Alibaba, China’s greatest e-emporium, added lots of them again in just some hours of buying and selling.

The federal government’s elevated sensitivity to market sentiment comes as a aid to many traders, who’ve watched with unease as leaders in Beijing have change into more and more detached to how China and its markets are considered by the skin world. The most recent coverage whipsaw nonetheless raises nagging questions on conflicting pursuits throughout the get together and concerning the lack of co-ordination between regulators. It’s unclear, for instance, if Mr Liu’s conciliatory message was supposed to sign displeasure with the cac’s latest heavy-handedness, or as an alternative to reward the company for having carried out an excellent job.

Whatever the authorities’s true motive, its pronouncements might cease the colossal worth destruction of the previous 18 months or so. Whether or not they are going to be sufficient to reverse it’s one other matter. Chinese language tech shares stay depressed. Tencent’s market capitalisation swelled by $85bn on the day of Xinhua’s report. However that introduced it again to the place it was 5 days earlier, which continues to be down by greater than half from its peak of practically $1trn in February 2021. Alibaba’s stockmarket worth of $250bn is one-third of what it was a 12 months in the past. If the Communist Social gathering’s goal was to take Chinese language tech down a peg and neutralise a perceived rival energy centre, it has succeeded in spades.