FEW COMPANIES are extra emblematic of the tech-obsessed, easy-money period of the early twenty first century than SoftBank, the Japanese funding conglomerate based and run by Son Masayoshi, or Masa for brief. Beginning life as an obscure Japanese software program distributor in 1981, it has made one debt-fuelled guess after one other to develop into an web agency, a telecommunications big, after which what Mr Son final yr referred to as the world’s greatest venture-capital (VC) supplier, comfortably forward of Tiger International, a New York hedge fund, and Sequoia Capital, a VC powerhouse. Elements of its balance-sheet are opaque but it continues to borrow closely and is without doubt one of the world’s most-indebted non-financial corporations. Like most of the Silicon Valley corporations it invests in, it has a dominant founding shareholder who is just not averse to spouting gobbledygook. Mr Son says he invests with a 300-year horizon, making SoftBank as near immortal as monetary corporations get. However it’s the right here and now that he needs to be most involved with.

Your browser doesn’t assist the <audio> factor.

That’s as a result of the tech growth, which SoftBank has each fuelled and benefited from, could also be coming to an finish. Within the face of the best charges of inflation in a long time, central banks have began to lift rates of interest. That threatens to tighten credit score markets for extremely leveraged entities like SoftBank. Extra necessary, increased charges make a giant distinction to the long-term worth of the form of high-growth tech startups it invests in, whose earnings are within the distant future. As one of many highest rollers in two of the enterprise megatrends of the previous few a long time, it’s price asking what would occur if tech fandom and simple cash show evanescent. As Warren Buffett as soon as mentioned, it’s solely when the tide goes out which you could see who’s swimming bare. What, Schumpeter wonders, is the state of Mr Son’s bathing apparel?

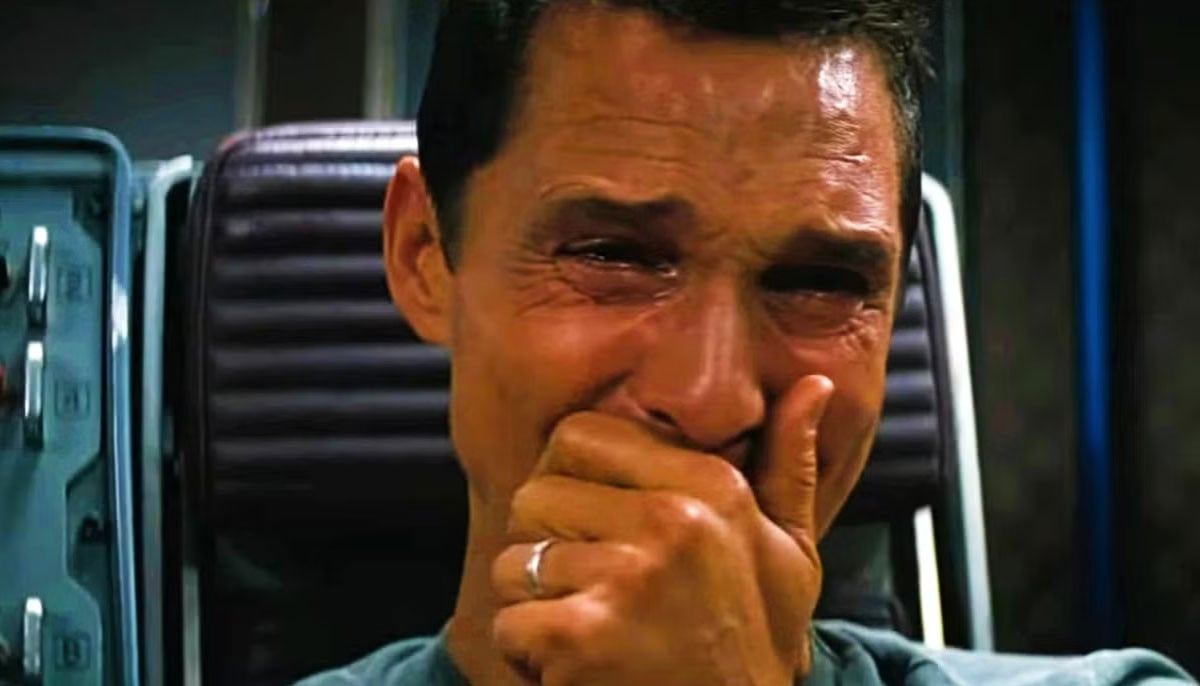

Mr Son, like Mr Buffett, enjoys a vibrant flip of phrase. On Feb eighth, reporting an 87% year-on-year stoop in SoftBank’s internet revenue within the 9 months to December, he was blunt. Not solely was the corporate within the midst of a blizzard that began final autumn, he mentioned. The storm had acquired worse in America and elsewhere due to the specter of rising charges. Although SoftBank eked out a small revenue in the latest quarter, the 2 most necessary variables that Mr Son watches like a hawk deteriorated sharply. One was the online worth of SoftBank’s portfolio of belongings, which fell by $19bn to $168bn. The opposite was the worth of its internet debt relative to fairness, which reached the best stage since 2018 when SoftBank floated its Japanese telecoms enterprise.

To gauge the dangers, begin with the asset facet of these calculations. Nonetheless a lot of a courageous face Mr Son places on it, excellent news is scant. On the day of its outcomes SoftBank confirmed that it had referred to as off the sale of its British chip enterprise, Arm, to Nvidia, a California-based semiconductor agency, due to regulatory stress. At Nvidia’s highest worth, the implied sale worth was above $60bn, or about twice what SoftBank paid for Arm in 2016. As a substitute SoftBank will promote shares in Arm in an preliminary public providing (IPO) within the subsequent monetary yr. Mr Son famous that the underlying earnings of Arm’s chip enterprise are estimated to have improved lately, which can make it extra enticing. But Kirk Boodry of Redex Analysis, an funding adviser, reckons an IPO has little probability of producing as a lot worth as a sale. Furthermore, potential traders want solely have a look at the poor public-market efficiency of just about all of the 25 firms SoftBank listed up to now ten months to know that tech IPOs are not a gravy practice.

Additionally on the asset facet are SoftBank’s troubled investments in China and in its two Imaginative and prescient Funds, which invested in a whopping 239 younger firms final yr. Alibaba, the embattled Chinese language tech big, was as soon as the cornerstone of SoftBank’s funding technique, accounting for 60% of internet belongings. Now SoftBank treats it like a get-out-of-jail-free card, promoting stakes to fund riskier ventures elsewhere. Its weight within the portfolio has shrunk to 24%. On February seventh Alibaba’s share worth fell by 6% on fears that SoftBank would minimize its stake but extra. For SoftBank, Alibaba is now vastly eclipsed in significance by its two Imaginative and prescient Funds, which account for nearly half of the group’s internet belongings. These inched up in worth in the latest quarter, largely due to valuation beneficial properties in unlisted corporations. If the stark sell-off of SoftBank’s publicly traded corporations is any information, nevertheless, it could be solely a matter of time earlier than valuations of corporations within the pre- IPO stage stagnate and even in some instances begin to slide.

SoftBank’s debt is worrying, too. It mentioned its loan-to-value (LTV) ratio, or internet debt as a share of the fairness worth of its holdings, was 22% on the finish of December, up from 19% three months earlier; it considers 25% to be affordable in regular instances. Nonetheless, others calculate the ratio extra conservatively, together with extra liabilities reminiscent of margin loans, funding commitments and share buybacks that SoftBank excludes. Sharon Chen of Bloomberg Intelligence, a financial-analysis agency, says that based mostly on her measurements, SoftBank is getting near the 40% LTV threshold that S&P International, a scores company, has mentioned may very well be a set off for a debt downgrade (although the plan to listing Arm may ease the stress). An extra sale of Alibaba shares may very well be used to chop debt, however may additionally decrease the standard of the portfolio—one other rating-agency purple flag.

Wetsuit, speedos or nothing in any respect?

SoftBank has had sufficient debt-related troubles up to now for Mr Son to grasp the risks. It has lengthy pledged to maintain sufficient liquidity readily available to fund two years of debt funds. It additionally advantages from a pool of banks and odd savers in Japan who just like the excessive yields it supplies in contrast with different Japanese debtors. However its longer-term monetary stability rests on two variables—the worth of its belongings and the scale of its money owed—which in present circumstances would profit extra from prudence than progress. Greater than a pair of speedos, Mr Son wants a wetsuit. ■

Learn extra from Schumpeter, our columnist on world enterprise:

How Sony could make a comeback within the console wars (Feb fifth)

Lakshmi Mittal reworked steelmaking. Can his son do it once more? (Jan twenty ninth)

Making sense of the East-West divide in tech (Jan twenty second)

For extra professional evaluation of the largest tales in economics, enterprise and markets, signal as much as Cash Talks, our weekly e-newsletter.

This text appeared within the Enterprise part of the print version below the headline “Does Masa have his trunks on?”